E-Mudra 59 Minute Loan Application Process

PM E-Mudra 59 Minute Loan can be a game-changer when it comes to getting financial support for your small business. This innovative initiative by the Government of India aims to simplify the loan application process for small and medium enterprises (SMEs) and help them get the much-needed funds on time. If you are interested in applying for E-Mudra 59 Minute Loan, it is essential to understand the application process thoroughly.

In this guide, we will walk you through the steps involved in applying for this loan and provide you with valuable information to help you navigate the process with confidence.

Loan Product

Eligibility Criteria

Before beginning the application process for an PM e-Mudra 59 minutes loan, it is important to ensure that you meet the eligibility criteria set by the lending institutions. Generally, these criteria include factors such as your business’s credit score, annual turnover, existing loans, and the overall viability of your business. It is advisable to review the specific eligibility requirements outlined by the participating banks or financial institutions to determine your eligibility for a loan.

Online Registration

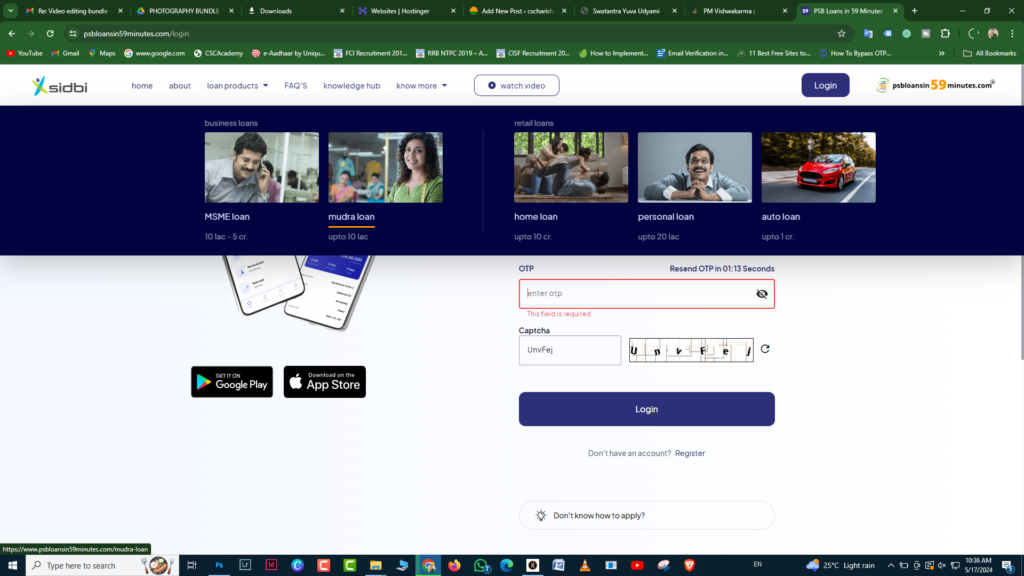

Once you have confirmed your eligibility for the PM e-Mudra 59 minutes loan, the next step is to complete the online registration process. You can visit the official website (https://www.psbloansin59minutes.com/) or the designated portal for e-Mudra loan application and create an account to get started.

During the registration process, you will need to provide the necessary details about your business, including its legal structure, financial history, and contact information.

It is important to ensure that the information you provide is accurate and up-to-date, as it will be used to evaluate your loan application.

Additionally, you may need to submit supporting documents as part of the registration process. These documents typically include business financial statements, tax returns, bank statements, and any other relevant records that demonstrate the financial position and operational stability of your business. Be sure to have these documents readily available in digital format to speed up the registration process.

Submission of Business Plan and Loan Application

After completing the registration process, you will need to submit a detailed business plan outlining the purpose of the loan, the intended use of funds, and the projected impact on your business.

The business plan serves as a crucial component of your loan application, as it provides lending institutions with information about your business’s goals, strategies, and potential for growth and sustainability.

Also, you will need to fill out the loan application form, providing specific details about the required loan amount, the preferred repayment period, and any collateral you wish to pledge as security for the loan. It is important to proceed with this step with careful deliberation, ensuring that the loan amount and repayment terms align with your business’s financial capabilities and long-term objectives.

Assessment and Approval Certificate

Once you submit your business plan and loan application, lending institutions will begin the process of assessing your eligibility and the viability of your loan request. This assessment may include an in-depth review of your business’s financial records, credit history, and overall market potential for your products or services. Additionally, lending institutions may conduct site visits or virtual interviews to gain a comprehensive understanding of your business operations and management practices.

It is important to remain accessible and responsive during this stage of the application process, as lending institutions may seek additional clarification or documentation to support your loan application.

Timely and transparent communication can significantly speed up the assessment process and demonstrate your commitment to meeting the requirements set forth by lenders.

Disbursement of Funds

After the successful evaluation and approval of your e-Mudra 59 minutes loan application, the next and final step is associated with the disbursement of the sanctioned funds. The funds will be transferred directly to your designated bank account, allowing you to use them for the intended business purposes outlined in your loan application and business plan.

It is essential to exercise prudence and financial discipline upon receiving loan funds, ensuring they are used in line with the proposed business plan to maximize their impact on the growth and sustainability of your business. Additionally, being aware of the repayment schedule and diligently adhering to repayment obligations will contribute to developing a positive and lasting relationship with lending institutions.

Documents For Loan

Fully paperless

| most have been link | * |

|---|---|

| Passbook to Aaadhaar pan card and mobile number | |

| all document same name | |

| Aadhaar link with same mobile number | |

| MSME certificate not mandatory | |

| GST: number not mandatory |

Contact Us

| Official Website Visit | https://www.psbloansin59minutes.com/signup |

| Contact | Mobile = 079-41055999 Email = support@psbloansin59minutes.com Address= first floor, ashwamegh elegance – 3, opp. sbi corporate office, sm road, ambawadi, ahmedabad – 380015 |

About for loan

This loan will be given to those people who actually want to do business and the government is helping them. So, if you also have an MSME certificate, then with its help you can take this loan and you will get this loan very easily. Your civil court should be in good condition and you should have a business through which you can show it to the government and get a loan and grow your business. This is the goal of the government to help you and you can move forward by doing your own work.